This crisis is different … in CEE banking!

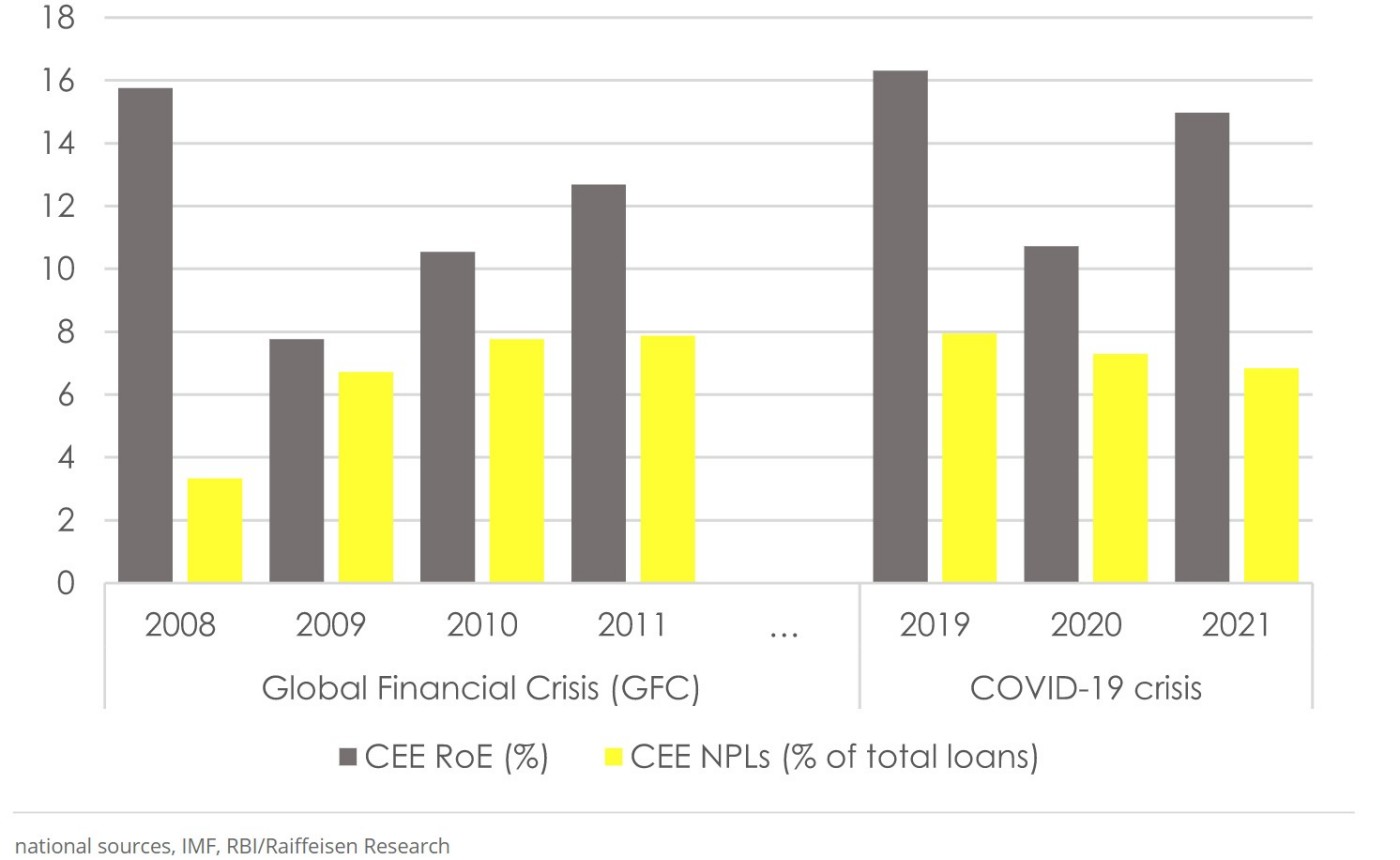

Economists and analysts shall be cautious about drawing (pre-emptive) conclusions that one crisis is different from previous ones. But this is definitely true for banking sectors in CEE in the COVID-19 context. There was no deleveraging like in the aftermath of Global Financial Crisis (GFC). Moreover, profitability returned quickly into double-digit territory based on solid business models plus cautious pre-crisis underwriting (and lowish NPLs). Not to forget that the mid-term outlook remains solid.

Double-digit exposure increases in CE/SEE … (geo-)politics matter in EE but no deleveraging

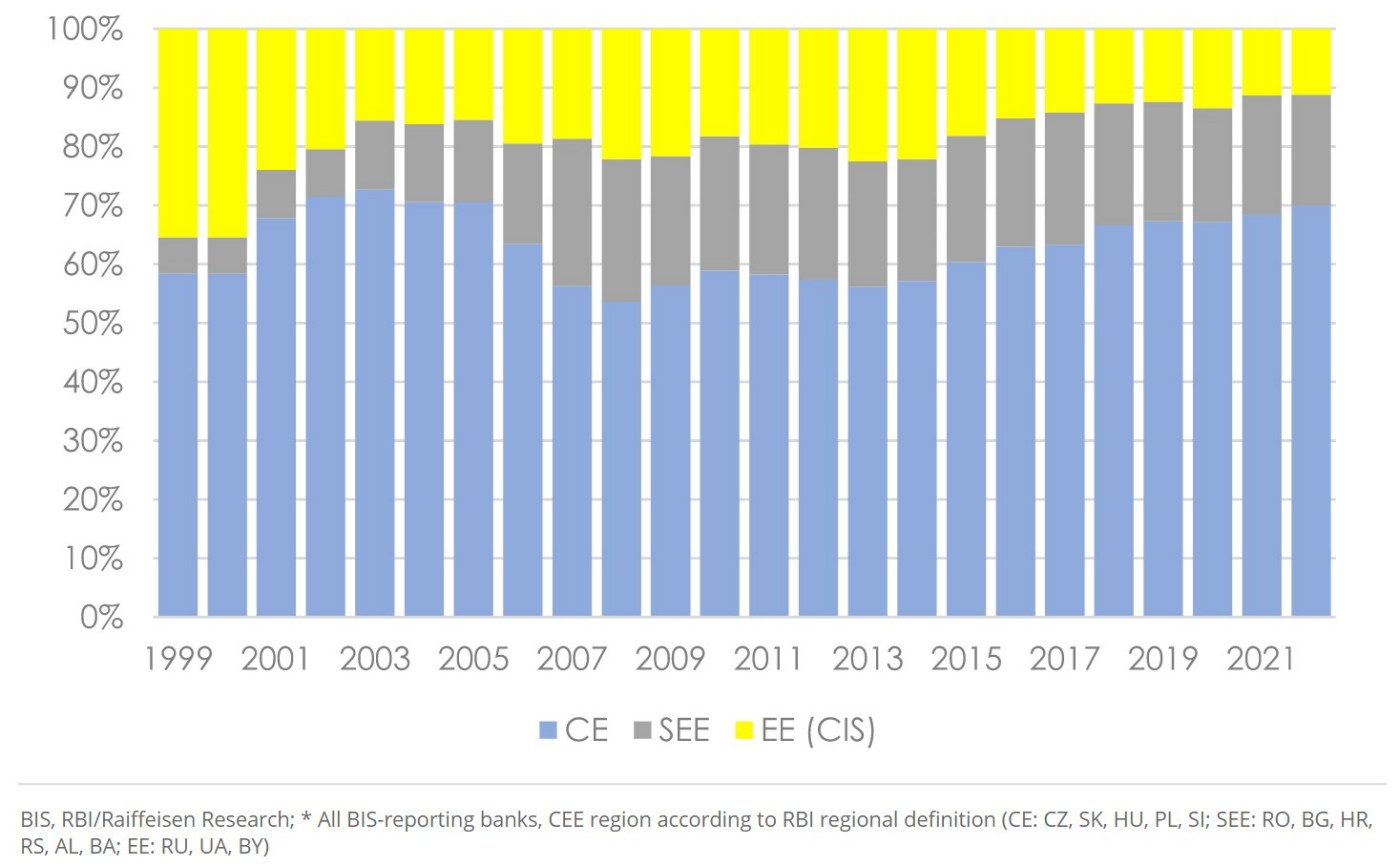

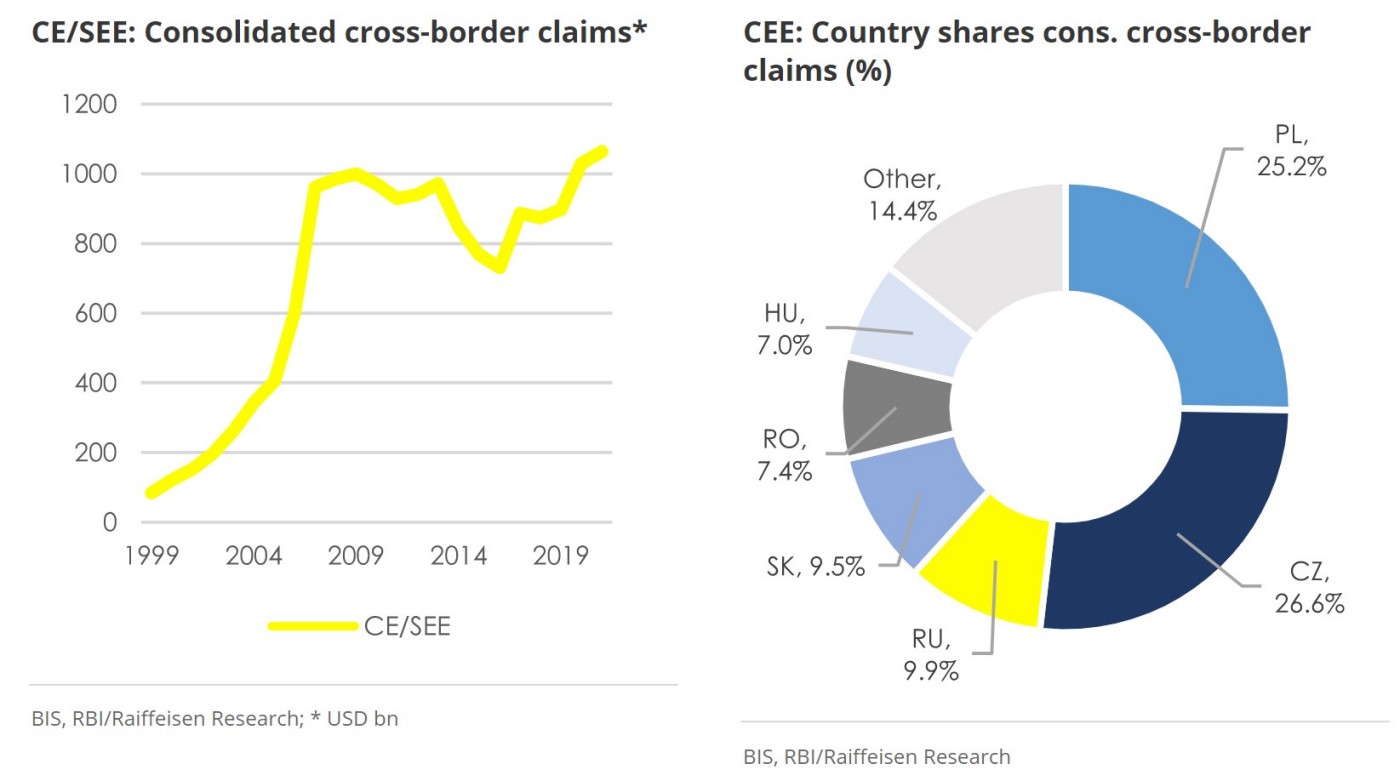

Compared to previous crisis times within the CEE region cross-border positions of international banks towards the CEE region and countries increased in the context of the COVID-19 crisis! Banks and international pan-European lenders were part of the (systemic) crisis response in the region. However, this positive development on aggregate masks certain regional differentiations. Cross-border positions (on a consolidated basis, i.e. including local claims in LCY and FCY plus cross-border businesses) remained more or less flattish in the EE region over the last 12-24 months. Measured from December 2019 to June 2021, cross-border exposures to the EE region dropped by -4%, from June 2020 to June 2021 they increased by 8%. However, this flattish development shall not be seen to negative either. In the aftermath of the GFC (as well as in the context of the Russia/Ukraine crisis in 2014) there was a brutal (external) deleveraging taking place for EE banking exposures. Therefore, stability is also a certain success here. The more stagnant development in EE stands in stark contrast to double-digit exposure increases towards the CE/SEE banking sectors over the last 12-24 months (+12 % Dec 19 to Jun 21, + 14% Jun 20 until Jun 21). In absolute terms exposures of Western banks to the CE/SEE region are back to the levels we have seen prior to the GFC some 10 years ago (around USD 1000 bn). It goes without saying that the expansion this time around is much more solid due to a moderate speed of expansion, while all major (Western) banking players in the region are running loan-to-deposit ratios in the range of 70-80%.

The overall positive lending and cross-border banking exposure performance reflects solid pre-crisis underwriting standards plus a substantial degree of accumulated resilience in the CEE banking sectors and at major regional lenders. Moreover, we think that the sketched regional divergences (EE vs. CE/SEE) reflect several structural factors. Firstly, Western banks are sitting on market shares in the range of 40-90% in CE/SEE which made them systemic actors in terms of crisis-fighting, while Western banks are acting as more selective niche players in the EE banking sectors (with single-digit market shares). Secondly, ongoing geopolitical tensions are likely to be reflected in cautious (cross-border) business strategies, while large-scale support in the EE economies was also provided by domestically owned (state-near) lenders. In light of the sketched trends the aggregated exposure of Western banks towards the EE region has reached its lowest point in relative terms over the last two decades in 2021. The reference to geopolitics is also reflected in the fact that the relative trend-decline accelerated substantially from 2014 to 2016. During this period of time the share of the EE region in international banking exposures dropped from 22% to 14% (based on substantial nominal cuts in exposures), now hovering around 11%.

| CEE: Share in consolidated cross-border claims (%)* |

Geopolitics matter for banking … but Russia (still) market to be and number three in CEE!

The “winners” in terms of (relative) increased importance in cross-border exposures in the CEE region are the CE countries. We see this trend as a reflection of relative stability, solid growth in Czechia and Slovakia, a once again increasing attentiveness of the Hungarian market, while exposures towards Poland are not really moving in either direction recently (up or down). Overall, exposures of international banks towards the CE region in relation to overall CEE exposures are currently standing at their highest level since 2004 (close to 70% of total), while we still remain somewhat below historical peaks in SEE (and obviously well below historical peaks in EE).

It goes without saying that the majority of absolute and relative exposure reduction towards the EE region over the last decade can be attributed to the Russian banking market (representing some 90% of EE banking exposures). For the first time over the last two decades exposures of international banks towards Russia do represent less than 10% of CEE exposures. Some further modest downside might be looming with the partial exit of Citi from the retail market in Russia. However, we would not over-dramatize this development either. In total exposure terms the Russian market represents still the third-largest country level exposures of Western banks in international banking statistics towards the CEE region, well behind Czechia and Poland, still somewhat ahead of Slovakia and Romania.

CEE: Banking sector KPIs in crisis times

(Post-)Covid Return on Equity in CEE banking back to 15%+ & 20%+ in EE

Positive exposure trends in the CEE region are definitely a reflection of solid business models as reflected in lowish NPL ratios in the context of the COVID-19 crisis plus a solid rebound of regional profitability. Currently, the CEE NPL ratio stands at 6.8%, its lowest levels over the last 5 years! Outside the EE region, NPL ratios are currently in a range of 2.9-4.8%. These are NPL ratios of “Developed Markets” … but with a totally different return profile attached. The average CEE Return on Equity (RoE) in the respective banking sectors on aggregate currently stands at around 15%, ranging from 23% (!) in the EE region to 10-12% in the CE/SEE region; taking the CE-3 region (CH, SK, HU) here as a benchmark with an average RoE at 12%, while the Polish market is still struggling with a RoE in low single digits.

The increasing adaptiveness of economies to the COVID-19 pandemic instills cautious optimism for the year 2022. Although a slowdown or normalisation of economic growth might test the banking systems for unresolved credit risks (IFRS 9 stage 2 loans) as the policy support effects wane, these pressures should be seen moderate for the moment thanks, inter alia, to the gained credit growth pace and rising interest rates that will support the earnings momentum in the near term. Otherwise, the region will stay in the spotlight for M&A activities, technological transformation and the evolving ESG agenda. Altogether, the CEE banking market is seen to stay on an even keel and carry on the solid performance into the next quarters.

Given all the trends and figures sketched previously we labeled our CEE Banking Report 2021 “As good as it gets in (post-)crisis times” (link to the full report, for registered users only). This title also reflects the hope that we are finally approaching post-crisis times in the course of 2022. On a positive note recent balance sheet data also show that the two largest lenders in CEE are (once again) two Austrian pan-European lenders (Erste + RBI, the latter once again slightly ahead of the friendly competitor UniCredit).